The Climate Change Authority's specious advice

/Alan Moran

There have been several hundred Australian analyses of climate change policy and its costs and benefits. Most have provided profundities and attractively presented impressive looking modelling, normally demonstrating that the medicine, though bitter at first, will make us better and possibly richer in the long run.

The latest such document is that of the Climate Change Authority and it does not disappoint.

It concludes, unexceptionally, that market mechanisms – in plain words a carbon tax — offer the lowest cost means of getting from A (a world where we would be at 650 parts per million CO2 equivalent) to B (a world where we would be at 500 parts per million).

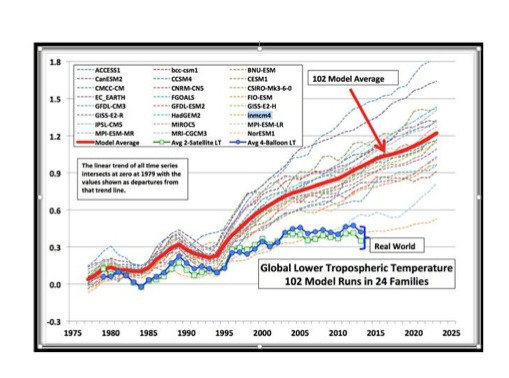

To achieve this means a net return of carbon dioxide, now buried in fossil fuels, back into the atmosphere which brings about a rise in average global temperatures. That increase is a little over 1°C (during Roman times temperatures were 2-6°C warmer than today) unless there is an additional feedback via water vapour but the climate models on which such a rise is estimated have so far proven to massively overstate the temperature record. The real world shows temperatures to have increased 0.3°C about a third of the rate forecast by climate models incorporating a water vapour amplification.

At the heart of the Climate Change Authority’s analysis is consultancy work commissioned from Jacobs, which puts the average cost of abatement 2020-2050 at under $30 per tonne of CO2. This translates into higher prices for electricity and other energy supplies. In the absence of carbon taxes and regulations, Australia would be able to generate electricity, mainly from coal, at about $40 per MWh; a $30 per tonne tax increases this by about 70 per cent. For household consumers once distribution and transmission costs are added-in this means a price rise of about 25 per cent; for large industrial consumers the price rise would approach 50 per cent.

Of course, if the economy proves highly flexible, the costs are even lower. But any flexibility operates largely by choking off large and intensive energy users – making us poorer. Politicians glibly assert, because the economic advisers they choose tell them, that we can manage with less energy and other inputs into production. They fail or choose not to recognise that this means reduced output and less income.

Moreover, the CCA’s “modelled” tax of $30 per tonne is a price that is one among a bewildering array of estimates. These include:

- A Brookings Institute paper which puts the price at $US65-167 per MWh if gas is to displace coal

- The OECD/Australian Treasury paper which puts the price for Australia at the equivalent of $US 75 per MWh

- Buried on page 251 of the Garnaut report is an estimated 2050 tax of $250 per tonne/MWh, a price that itself incorporates some heroic assumptions about new technologies.

- In 1994 ABARE put the tax Australia would need to achieve a 20 per cent reduction in CO2 emissions at $600.

Moreover, it appears that the $30 per tonne tax was selected arbitrarily and the consultants were required to use it. The CCA on page 13 of Jacob’s modelling has a tax of $67 per tonne rising to $270 per tonne. A tax of $30 per tonne might mean a wholesale electricity price of $70 per MWh compared with the business-as-usual price of $40. But a tax of $270 per tonne lifts the wholesale price to over $300 per MWh.

Not only, therefore is the CCA report a case of garbage-in-garbage-out but the garbage put into the report itself has been tampered with. This document confirms the original intent of the Abbott Government to scrap this sorry excuse for an advisory body as being correct.

No coal. No oil. No fracking. No nuclear. No GMOs. A different world is possible!